LONDON: A new survey of business leaders in Saudi Arabia and the United Arab Emirates reveals widespread corporate optimism in both countries about the year ahead, despite uncertainties and challenges affecting the global economy in 2022.

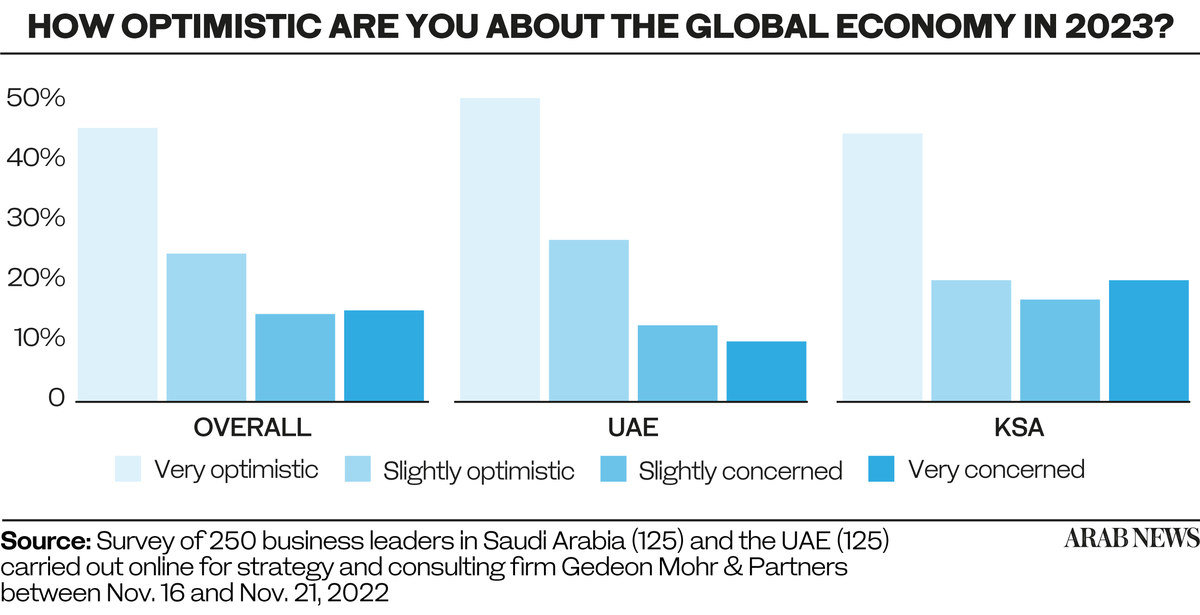

Overall, 70 percent of the 250 decision-makers representing various sectors expressed optimism about the prospects for the global economy in 2023, while 46 percent declared themselves very optimistic.

The survey was conducted for Gedeon Mohr & Partners, a newly formed Dubai-based consultancy focused on the retail, entertainment, destinations and hospitality sectors, all of which are set to play an increasingly important role in transforming the economies of the Arabian Gulf. region.

“It is extremely positive to see the majority of business leaders in the UAE and KSA being so optimistic about the future of the economy,” said Maria Gedeon, CEO and Founder of Gedeon Mohr & KSA. partner.

“Obviously, we are fortunate that oil prices are up, so naturally the economy is in better health than anywhere else in the world. Also, geographically the region is further away from the Russia-Ukraine war, and Less affected by high prices etc than in Europe.

“But overall, I think the sentiment is better because both governments are working to develop economies, raise the quality of life, and attract foreigners and expatriates to this part of the world.”

The survey also showed that a total of 29 percent of business leaders in both countries – rising to 22 percent in the United Arab Emirates, 37 percent in Saudi Arabia – were somewhat or very worried about what the new year might bring.

“I think these are probably working for global organizations, because they have layoffs and a lot of financial issues, and a slowdown in growth, and so on,” Gideon said.

He said businesses in both countries are taking guidance and confidence from the ambitious blueprint laid out by the governments.

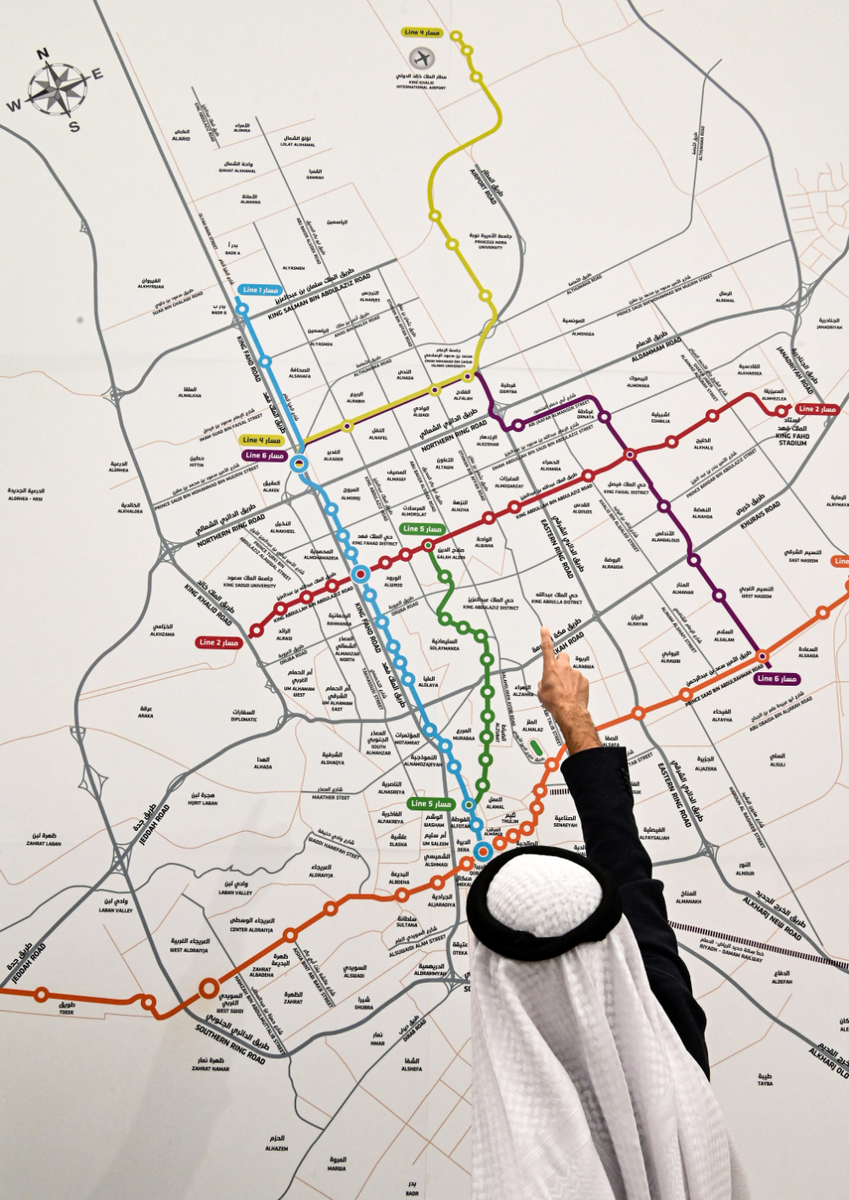

“These two countries have announced their vision for the Kingdom for 2030 and the United Arab Emirates for 2031, and mega-projects in Saudi (Arabia) in particular, such as NEOM, the Red Sea Project and Qidiya, and large-scale investment in infrastructure.” published. Tremendous economic catalysts.”

In November the International Monetary Fund predicted that GDP growth in Saudi Arabia would hit 7.6 percent for 2022, placing it among the world’s top five high-growth economies.

Policymakers from the Gulf Cooperation Council as a whole, the IMF, “managed to quickly mitigate the economic impact of the twin COVID-19 and oil price shocks.”

The IMF also introduced a warning note, warning that even though GCC states “benefit from high, volatile, oil and gas prices, a number of risks still cloud the outlook – in particular, in the global economy”. Recession.

“In this context, the reform momentum established in previous years must be maintained … to ensure equity between generations and a smooth energy transition away from fossil fuels.”

That was exactly what was happening, Gedeon said, as Saudi Arabia works to diversify its economy and open up its society. As a senior manager with the UAE’s Majid Al-Futtaim Group, a mall-to-hotel, retail and entertainment giant, he had first-hand experience of the ongoing program of social and economic reforms in Saudi Arabia when he led the group. Worked on the debut of K Vox Cinema. chain in the country.

Both Gulf states “will continue to invest in oil, but they are keen to diversify,” he said, and a clear path forward is driving significant tourism to “very beautiful countries.”

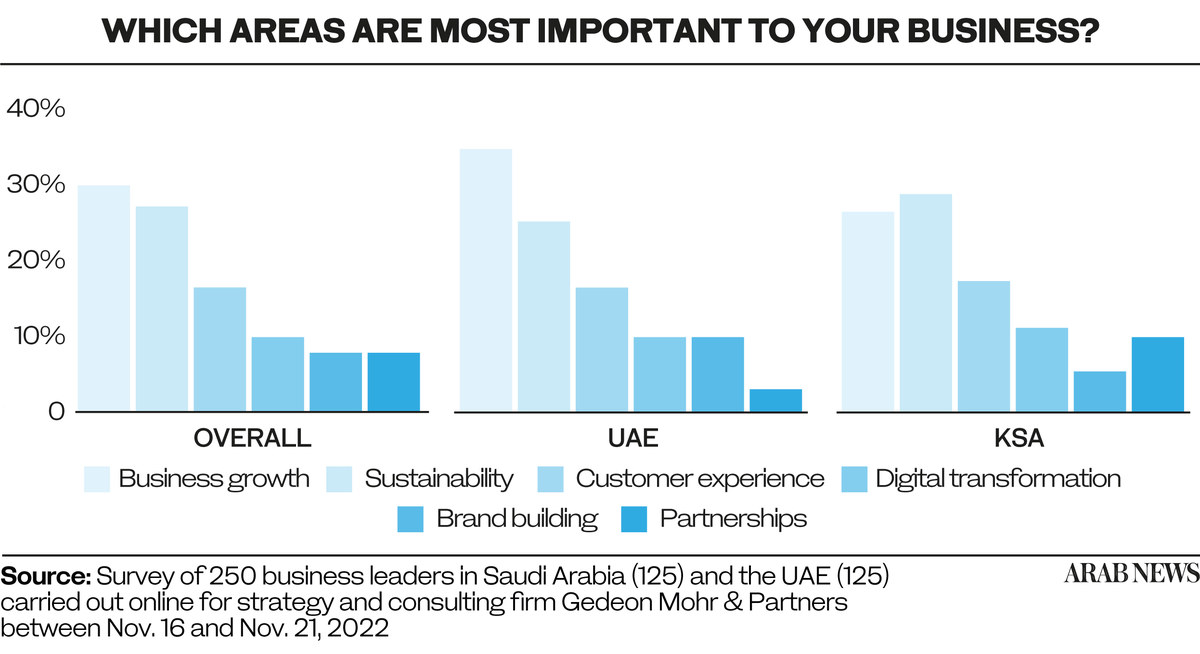

One thing that emerged strongly from the survey is that climate change and sustainability issues are rising to the top of the agenda for businesses in both countries. When asked how important sustainability is to their business, 90 percent of respondents in the UAE and 85 percent in Saudi Arabia said it was very important. Overall, only 2 percent said it was not important.

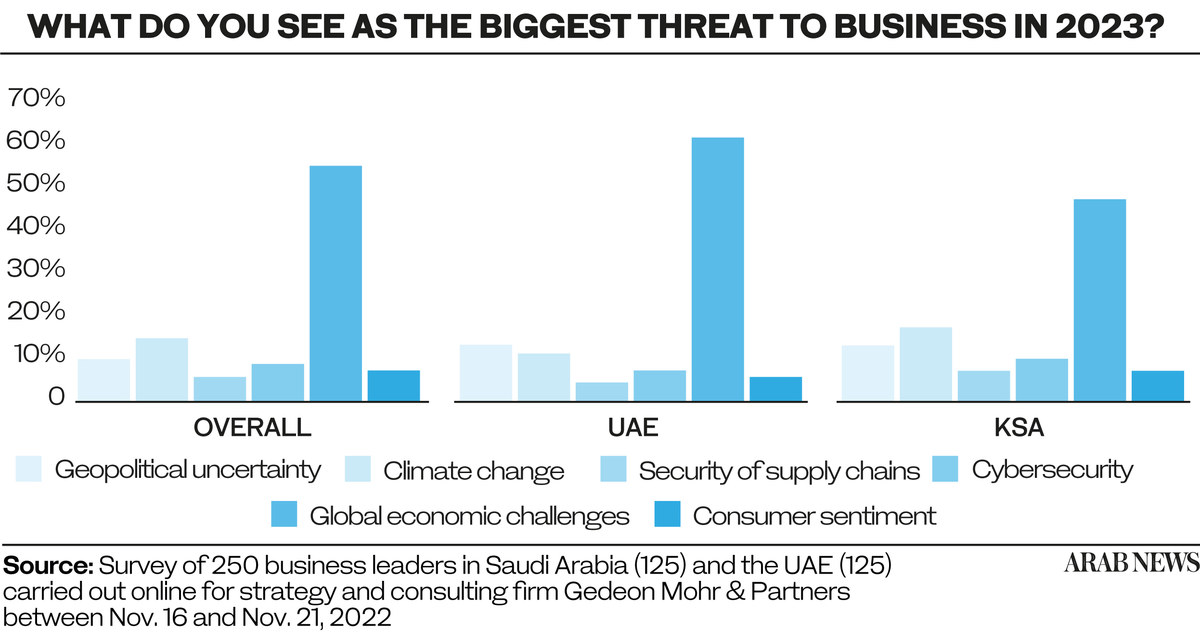

11 percent of respondents in the UAE and 18 percent in Saudi Arabia see climate change as the biggest threat to business in 2023.

More surprising, however, and says Gedeon, is the attitude that emerges from the survey in both countries toward the thorny corporate issue of ESG, or environmental, social and governance, a metric increasingly valued by investors and consumers. How companies impact and interact with society and the environment.

In its recent 2022 Social and Governance Report, PwC Middle East concluded that “embedding environmental, social and governance principles into all areas of economic and social development is essential to realizing our region’s ambitions, making it a global leader.” Be a leader on the sustainability platform.”

In the new survey, Gideon says, “Sustainability and business development top the agenda, yet it is clear that leaders care about climate change, yet there is much work to be done around ESG, which offers opportunities for sustainable development.” does.

The bottom line, she says, is that increasingly “consumers want to buy from and engage with brands that have a solid purpose, and that are doing good for the planet and the organization.

“Consumers will no longer buy a product from a company or brand that is not respecting all these sustainability and ESG pillars, and companies that are not doing so will simply become obsolete if they are not transparent about their policies and procedures. about how they are reducing their carbon footprint.”

Again, government initiatives are likely to bolster the momentum. The staging of COP27 in Egypt last month, and the fact that the next Conference of the Parties will take place in the United Arab Emirates next year, has put environmental and social responsibility issues front and center in the thinking of governments, businesses and individuals across the region. ,

It is also of great importance that the UAE and Saudi Arabia, the world’s two largest oil producers, have committed to achieving net-zero carbon emissions by 2050 and 2060 respectively – ambitious goals that will demand the cooperation and collaboration of businesses across every sector. , and will almost certainly be legislated for.

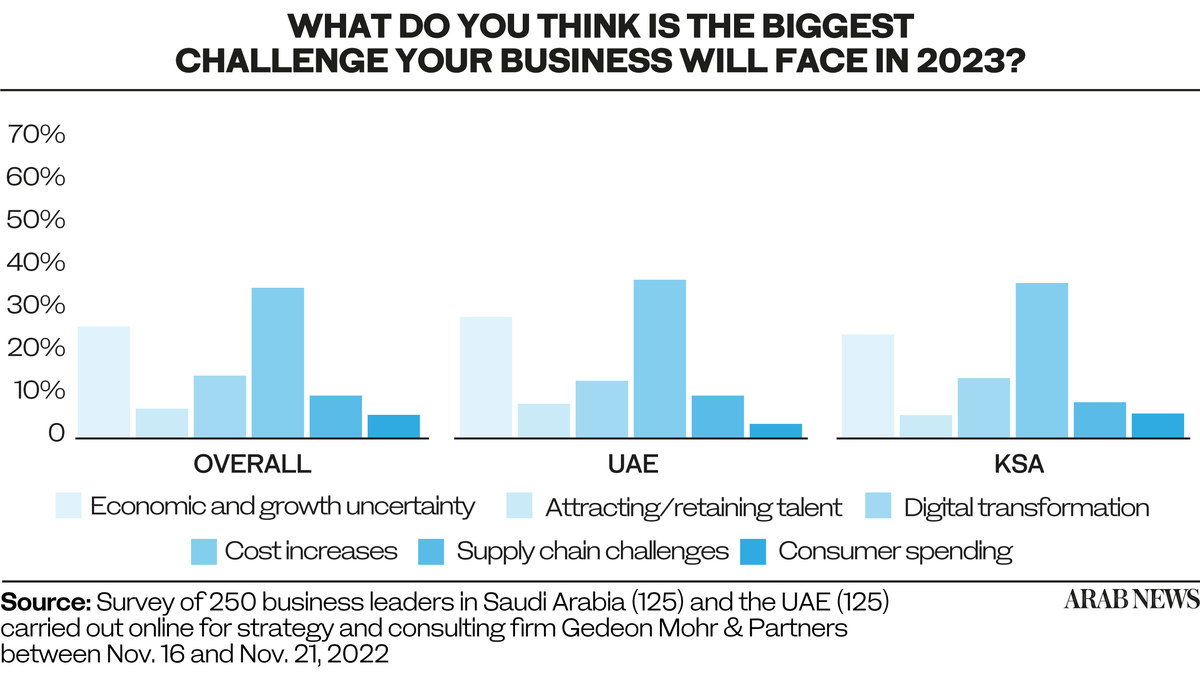

One issue of concern that slightly dampens overall confidence identified by the survey is the recruitment and retention of the talent needed for companies to perform at their best.

A quarter of all respondents see hybrid working as a challenge in 2023, despite a generally positive experience with remote working during the COVID-19 lockdown. One reason, Gedeon said, was due to the unique nature of the many large projects underway, particularly in Saudi Arabia.

“A lot of these projects are really remote and you need to be there to see the project develop,” she said.

“If you are developing on the Red Sea, it will be very difficult to manage a project operating from New York, London or even Dubai.

“Therefore, projects like NEOM are keen to have people on site, and they are building staff housing and even schools, making it exciting for people to work so far away from the capital and other cities. Is.”