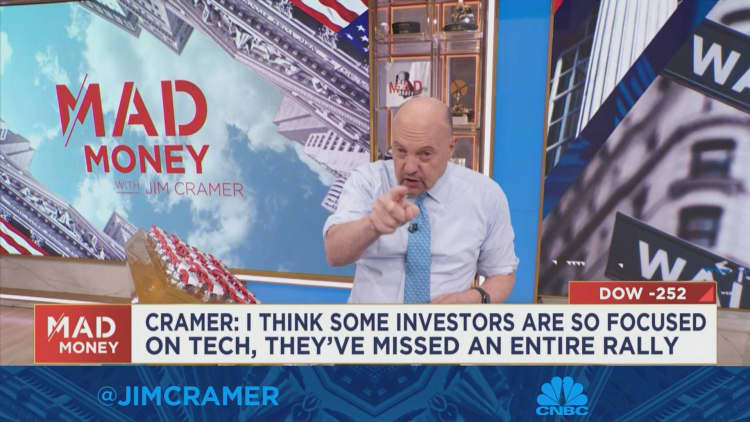

CNBC’s Jim Cramer said Thursday that the carnage in tech stocks is hiding a bull market in other names.

“We had a very traditional bull market based on the dollar and rising interest rates, both of which are great for stocks,” he said, adding that “Tesla and Salesforce and Amazon continued to decline.” obscuring.

Stocks fell on Thursday after the Labor Department reported that initial filings for unemployment insurance fell to their lowest level since September, indicating the labor market is warming despite the Federal Reserve. interest rate hike,

He said that although stocks have declined in the recent past, there are still many stocks that are bullish. shares of companies including Visa, master card, JPMorgan Chase And boeing That bottomed out late last year, according to Cramer.

“These huge stocks have had monstrous, happy moves over the past few months — which is what we’ve seen this week.” just a systematic decline To burn off their extremely overbought position,” he said.

Kramer, who is stuck that investors should stay away from mega-cap tech names, told investors not to make the mistake of Wall Street by getting caught up in the decline of tech stocks.

“Let’s remember, there are two tracks out there. The tech track that can’t seem to find its footing, ensconced in about 30% of the market, and the other track that has found its footing months and months ago,” he said. Told.

Disclaimer: The Cramer Charitable Trust owns shares of Salesforce and Amazon.