CNBC’s Jim Cramer told investors on Friday that they should look to add stocks as earnings season drags on.

“There’s plenty to buy, as long as you buy money-making companies and return some of that money to shareholders through buybacks and dividends,” he said. “Still too soon to pick high-growth stocks with little in the way of earnings.”

Stocks were mixed on Friday, with the S&P 500 closing slightly higher as it noted its worst weekly performance in nearly two months. All the three major indices closed with losses during the week.

Cramer reassured investors that the market’s decline this week does not mean it is headed into bear territory. “Right now, we’re seeing classic bull market behavior. There are moments in a bull market where pessimism thickens.”

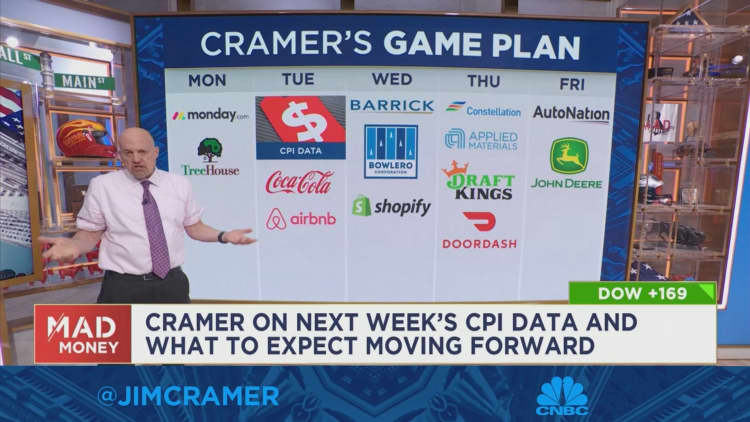

In addition to the corporate earnings report, he said he is eyeing the January Consumer Price Index report on Tuesday.

All estimates for the week’s earnings, revenue and economic data are courtesy of FactSet.

monday: Treehouse Foods

- Q4 2022 Earnings Released at 6:55 am ET; Conference Call at 8:30am ET

- Estimated EPS: 98 cents

- Estimated revenue: $1 billion

“To date, we haven’t seen much of a drop in business in supermarkets of any size. … But once that happens, it will be a major victory in the fight against inflation,” he said.

Tuesday: Coca-Cola, AirBnB

- Q4 2022 Earnings Released at 6:55 am ET; Conference Call at 8:30am ET

- Estimated EPS: 45 cents

- Estimated revenue: $10 billion

Cramer said he expects a solid quarter from the beverage giant.

- Q4 2022 Earnings to be Released at 4:05 PM ET; Conference Call at 4:30 PM ET

- Estimated EPS: 25 cents

- Estimated Revenue: $1.86 billion

“I’ve been maintaining that this company is undervalued, but I don’t know when it might break to the upside,” he said.

Wednesday: Bolero, Shopify

- Earnings release after the end of the second quarter of 2023; Conference Call at 4:30 PM ET

- Estimated EPS: 16 cents

- Estimated Revenue: $257 million

Cramer predicted that the company would provide a large set of numbers.

- Earnings Release After Q4 2022 Close; Conference Call at 5 PM ET

- Estimated loss: 1 cent per share

- Estimated revenue: $1.65 billion

He added that the company must show that it can grow to profitability.

Thursday: Constellation Energy, Applied Materials, DraftKings, DoorDash

- Q4 2022 earnings release at TBA; Conference Call at 10 AM ET

- Estimated EPS: 26 cents

- Estimated revenue: $3.63 billion

“As long as a Democrat is in the White House, I’ll be with it,” he said.

- Q1 2023 Earnings to be Released at 4 PM ET; Conference Call at 4:30 PM ET

- Estimated EPS: $1.93

- Estimated Revenue: $6.69 billion

Cramer said he is betting the company will report a weak quarter.

- Earnings Release After Q4 2022 Close; Friday Conference Call at 8:30 AM ET

- Estimated loss: 61 cents per share

- Estimated Revenue: $798 million

“I like DraftKings. I like CEOs. … But I don’t like the legislative road map,” he said.

- Q4 2022 Earnings to be Released at 4:05 PM ET; Conference Call at 5 PM ET

- Estimated loss: 67 cents per share

- Estimated Revenue: $1.77 billion

He said the company needs a plan to turn profitable as the market only cares about companies that can make solid earnings.

Friday: Deere

- 2023 Q1 Earnings Released at 6:45 AM ET; Conference Call at 10 AM ET

- Estimated EPS: $5.54

- Estimated revenue: $11.34 billion

According to Cramer, Deere stock is the best way to play a long-term bull market in agriculture.