Canada’s massive increase in housing prices during covid-19 pandemic had more to do with investor demand and rock-bottom Rate of interest than to repeatedly talk about concerns of inadequacy housing supplyAccording to the Bank of Montreal’s top economist.

Doug Porter published a short note Wednesday morning that explored the increases in home prices seen in Ontario cities such as Chatham-Kent in the two years after the pandemic.

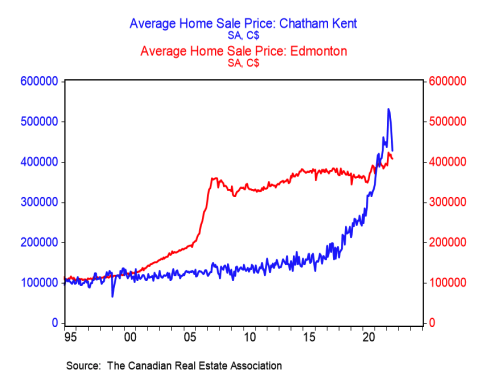

Home prices rose about 90 percent during that time, Porter wrote, contrasting the city with Edmonton, which experienced more moderate growth during the pandemic.

Although the value of homes in Chatham has briefly increased compared to Edmonton, the southwestern Ontario city has seen a sharp drop in prices since the Bank of Canada began raising interest rates earlier this year. .

A BMO housing analysis shows home prices in Chatham-Kent, Ont., accelerated sharply during the pandemic, eclipsing the more moderate growth of Edmonton, Alta.

BMO/CREA figures

Porter concluded that while rising interest rates dampened buyer demand, with little change in the supply of housing units in cities such as Chatham during the spring, the ultimate cause of higher prices during the pandemic was not a shortage of homes.

“Our idea, and I know it’s not popular, it was more a story of demand than a story of supply,” he told Global News in an interview on Wednesday.

The Canadian housing supply gap is regularly raised as a barrier to affordability in the Canadian residential real estate market.

Canada Mortgage and Housing Corporation (CMHC) report released in June Projecting that, when it comes to the goal of affordable homes for all residents, Canada will drop by 3.5 million units by 2030.

Jean-François Perrault, chief economist at Scotiabank, released an analysis in early 2022 showing that Ontario’s housing supply deficit is the worst in the country — and Canada already sits at the bottom of the G7 in per capita housing stock.

“If we don’t fix this, if we don’t properly size the number of homes in Canada or Ontario relative to the needs of the population, things will never be more affordable,” Perrault told Global News at the time.

In April, the federal government put a significant focus on boosting Canada’s housing supply in its 2022 budget, unveiling $4 billion housing accelerator fund plan To build more houses.

Porter said there is definitely a need for a stronger housing pipeline, especially given Canada’s ambitious immigration goals. But valuing Canada’s housing gap from the standpoint of the pandemic – when lower interest rates made mortgages cheaper and investors more likely to enter the market – may not be the most accurate picture for gauging demand.

“I think we should move away from the view that we are not building enough to house everyone. We may not be building enough to meet all of the investment demands, but I The interest rate hike that we have seen in the last six months seems to be going to result in lower investment demand.Global News.

“The fact that prices have changed … as a result of a modest increase in interest rates so violently over the past few months, tells me that things have heated up wildly. And now we are back to reality in fairly short order.” Going, I guess.

Porter also acknowledged that supply isn’t the only problem in Canadian cities. But while it makes sense to discuss density and supply concerns more enthusiastically in cities like Toronto and Vancouver, cities like Chatham don’t have the benefit of raising prices by 90 percent over two years.

“It’s strange to talk about supply shortages in many areas outside major cities,” he said.

“I think when you move out of the greenbelt, supply is not a big problem.”

Report shows Ontario shrinking housing capacity faster than any other province amid COVID-19

Mike Moffat, senior director of the Smart Prosperity Institute, did not disagree with Porter that rock-bottom interest rates and fears of missing out on the hot housing market fueled activity through the pandemic. But he told Global News in an email on Wednesday that he is “surprised” by the argument that supply is not a major factor in price increases in these regions.

Moffatt said markets in southwestern Ontario suffered a “considerable shortfall” that drove prices back to 2017 — before the pandemic.

Porter reiterated that he is not against policies that promote healthy levels of housing supply, but said he would like to see a shift in the conversation that focuses on the role of the Bank of Canada’s monetary policy and other demand-side factors. keeps in Epidemic price advantage.

“Don’t get me wrong, with some of our aggressive targets for immigration and strong population growth, we definitely need a steady supply of new housing. There’s no two ways about it,” he told Global News.

“I think as much attention should be given … trying to disrupt the demand side as well and trying to reduce some of the financialization of housing.”

© 2022 Global News, a division of Corus Entertainment Inc.