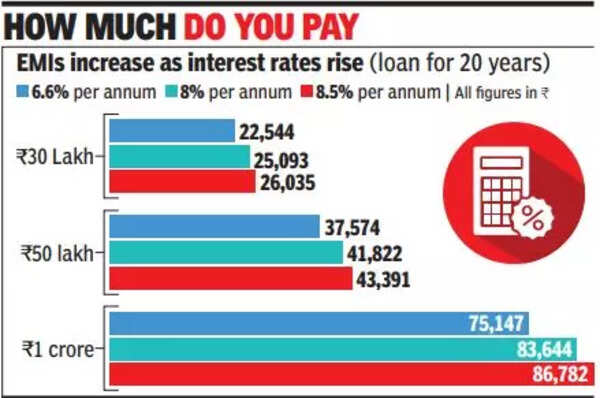

This is the third consecutive sharp increase after 40 bps in May and 50 bps in June. reserve Bank of India Governor Shaktikanta Das Have withdrawn all cuts during the pandemic and reverted rates to pre-pandemic levels. A 50-basis point or half-percentage point increase in home loan rate will increase the EMI on a 20-year home loan of Rs 1 crore from Rs 3,085 to Rs 83,644 from Rs 80,559.

The repo rate is the rate at which the central bank lends money to banks and is the benchmark for about 40% of loans, which will result in automatic readjustments.

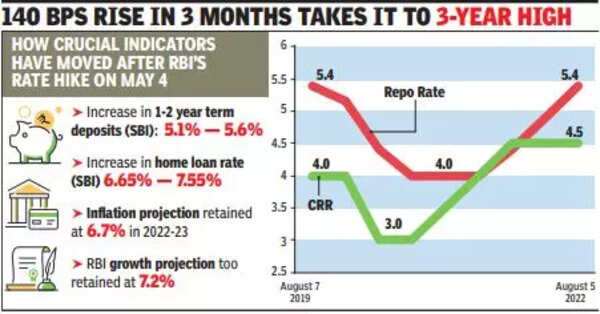

While the rate hike was on the high end of market expectations, the RBI retained its 2022-23 projections for both GDP growth (7.2%) and inflation (6.7%), which helped quell sentiment.

Sensex closed 89 points higher at 58,387, while rupee ended 23 paise higher at 79.24 after touching a high of 78.94.

The RBI rate hike comes as crude oil and international commodity prices show signs of softening amid fears of a slowdown in the West. However, RBI’s action seems to have been influenced by volatility in the rupee, which recently hit 80 against the dollar. The RBI has spent over $40 billion of its reserves to protect the rupee. With this increase, the RBI has tied up with other central banks, which have increased rates far more than in India.

Terming inflation above 6% as unacceptable, Das said the stability and resilient growth of India’s macroeconomic and financial sector gave room for the RBI to act on rates.

RBI doubles home loan limit for cooperative banks

With its latest revision, RBI has increased the repo rate by 140 basis points from May 4 – the highest increase in a decade. Along with the repo rate, the RBI also revised the Fixed Deposit Facility (SDF) to 5.15%. SDF is a facility where banks keep their surplus liquidity with RBI.

To boost housing demand, which is likely to subside due to interest rate hike, RBI has doubled the home loan limit for co-operative banks. RBI has also allowed rural cooperative banks to provide loans to commercial real estate for housing projects.

Markets were expecting a rate hike of between 35 and 50 basis points. Das said domestic economic activity is resilient and moving broadly in line with the MPC’s June proposal. Consumer price inflation has moderated since its surge in April, but remains uncomfortably high and above the target upper limit. Inflationary pressures are broad-based, and core inflation remains elevated

Repo rate hike will affect existing home loan borrowers

The 1.4 per cent hike in the repo rate in the last three months has impressed potential home buyers. And, it has hit the existing ones even harder as they have limited space to negotiate a better deal.

RBI increased the repo rate by 90 basis points (100 bps = 1 percentage point) in two tranches – 40 bps in May and 50 bps in June. Many banks have also increased their rates on the same lines.

Repo rate is the rate at which the central bank lends money to banks. For existing borrowers, home loan rates will go up at par with the increase in the repo rate as their rates are directly linked to it. But new buyers borrow at the rates fixed by the banks, adjusting the hike in the repo rate. The increase in new home loan rates is less than the overall increase in repo rates.

SBI on Friday raised its rate for best customers to 7.55% from 6.65% per annum in April before the latest hike of 50bps in the repo rate. Similarly, other banks also increased rates in proportion to the increase in policy rates.

However, many banks bear some part of the cost associated with the increase in policy rates due to competition. The cost of funds for banks is dependent on deposit rates. But, most of the banks have not increased the deposit rates to keep pace with the hike in the repo rate.

According to RBI data, the interest rate on fixed deposits of more than one year was between 5% and 5.6% in April 2022, which increased to between 5% and 5.75% in July, during which the RBI increased the repo rates by 90bps. increased of. Many banks did not increase lending rates to match the increase in policy rates for this reason. Instead, banks like Indian Overseas Bank increased their home loan rates to 7.05%, Central Bank Of India From about 6.6% in April 2022 to 7.2% by July 2022, Bank of India and Bank of Maharashtra to 7.3%.

As the home loan rate for existing borrowers had already increased by 0.9 percentage points on Friday by 50 bps, their EMIs have gone up by 11% since April. If the repo rate hikes by another 50 bps as expected in the September review, the overall increase in EMIs for existing borrowers will be 15.5 per cent, which is higher for already financially overburdened home buyers.

Industry players say the hike will have a negative impact on the real estate sector. Niranjan Hiranandani, MD, Hiranandani Group, said that since home loan lending is at flexible rates, the hike in short-term interest rate will hurt the sentiments of homebuyers.