The current long battle of global food inflation Almost started with edible oils from the end of 2020. Can it end up with edible oils?

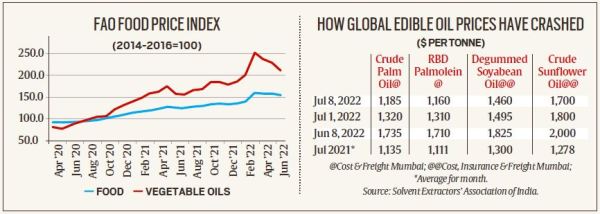

As far as overall food inflation is concerned, it is still early days. The Food Price Index of the United Nations Food and Agriculture Organization (FAO) reached an all-time high of 159.7 points in March, the month immediately following the Russian invasion. Ukraine, Since then, the index – the weighted average of world prices of a basket of food items at the base period price, taken at 100 for 2014-15 – has dropped 3.4 per cent in June to 154.2 points.

The picture is clearer in vegetable oils, where the FAO sub-index fell 15.9% between March and June, from 251.8 to 211.8 points. There was a sharper than normal index (92.5 to 159.7 points) for vegetable oils (from 81.2 to 251.8 points) during April 2020 to March 2022. But the next fall between March and June remained the same (see chart).

Palm Vs. ‘Soft’ Oils

The fall in prices can be better predicted by looking at the different oils. Crude palm oil (CPO) traded at a record 7,268 ringgit per tonne on the Bursa Malaysia Derivatives Exchange on March 9. On Friday, the most active two-month futures contract closed at 4,157 ringgit. This is 42.8% below the peak.

Four months ago, the landed price (cost plus freight) of CPO in India was around $2,000 a tonne, while it was $1,960 for RBD (refined, bleached and deodorized) palmolein, $1,925 for crude degumed soybean oil and $1,925 for crude sunflower. for oil was $2,100. These prices have since dropped to $1,185 (CPO), $1,160 (RBD palmolein), $1,460 (soybean) and $1,700 (sunflower) per ton.

The accompanying table shows the decline in prices over the past month, with palm declining more than so-called soft oils, namely soybean and sunflower. This is also reflected in the data from the Department of Consumer Affairs. Between June 8 and July 8, the all-India modal (most commonly quoted) retail price of packaged palm oil has come down from Rs 160 to Rs 145 per kg; It has been lower for soybean (Rs 170 to Rs 160 per kg) and sunflower (Rs 190 to Rs 182.5), and non-existent for groundnut (Rs 180).

“The transmission of international to domestic prices for imported oils will be higher and will require less travel time,” says BV Mehta, executive director, Solvent Extractors Association of India (SEA).

India consumes about 23 million tonnes (mt) of edible oils annually, of which 13.5–14.5 mt is imported and 8.5–9.5 mt is produced domestically. Imported oils mainly include palm (8–9 million tonnes), soybean (3–3.5 million tonnes) and sunflower (2–2.5 million tonnes), while indigenously obtained oils include mustard (2.5–2.8 million tonnes). tonnes), soybean and cottonseed (1.2–1.3 million tonnes). each), rice bran (1–1.1 million tonnes) and groundnut (0.5–0.8 million tonnes).

“Tank oil tanker ships from Malaysia and Indonesia take 8-10 days to reach India. The same is 40-45 days for soybean oil from Argentina and Brazil. Given the steep fall in international prices of palm oil and the short time taken to bring in fresh cargo, it is only natural that it becomes cheaper before other oils,” says Mehta.

Being a ‘hard’ oil that is semi-solid (as opposed to a liquid) at room temperature, palm oil is not used much in home kitchens for direct cooking or frying. Much of it goes into hydrogenated fat (vegetable, margarine and bakery shortening) or as a major ingredient in breads, biscuits, cookies, cakes, noodles, sweets, snacks, frozen desserts, soaps and cosmetics. Mainly the food, restaurant or skin care industries will get more benefit from the fall in palm oil prices than households. They want the prices of ‘soft’ (soybean and sunflower) and indigenous (mustard and groundnut) oils to fall further.

On the other hand

Daveesh Jain, president of Indore-based Soybean Processors Association of India, feels the government should review the current import duty on edible oils, given the recent fall in world prices and the ongoing planting season for kharif oilseeds.

Currently, the effective import duty on crude palm, soybean and sunflower oil is 5.5%, while it is 13.75% for RBD palmolein. In addition, the Center on May 24 allowed import of 2 million tonnes of crude soybean and sunflower oil at zero duty during 2022-23 and 2023-24 (April-March). Quantities above this will attract a regular 5.5% charge.

Domestic soybean prices have already fallen to Rs 62,000 per tonne from around Rs 69,000 last month. If the trend in international prices continues, it will send a negative signal to farmers when kharif sowing is at its peak. A rollback of customs duty exemptions and even a gradual increase is in order,” explains Jain.

According to the agriculture ministry, farmers had sown 77.80 lakh hectares (LH) under kharif oilseeds till July 8, compared to 97.56 lakh hectares in the same period last year. There has been a reduction in the area under soybean (69.54 lh to 54.43 lh), groundnut (25.31 lh to 20.51 lh) and sesame (1.71 lh to 1.53 lh). The low-lying region has been attributed to weak monsoon activity in June, with all-India rainfall falling 7.9% below the historical average and over 10% deficiency in 24 of the country’s 36 meteorological subdivisions.

In July, however, 31.3% more rainfall has been recorded so far, resulting in a 5.2% surplus of cumulative rainfall from June 1 to July 10. Mehta of SEA expects sowing to pick up significantly with the resumption of monsoon and closing the acreage gap before the end of the month.

Ukraine to Indonesia

As mentioned earlier, the current global food inflation has been triggered by edible oils. The initial triggers were the 2020-21 drought in Ukraine (the world’s largest sunflower oil producer) and a Covid-induced shortage of migrant workers in Malaysia’s oil palm plantations. The war was the last straw. Indonesia’s restrictions on palm oil exports due to rising domestic prices and a drought in South America exacerbated supply disruptions from Ukraine and Russia, severely affecting the region’s 2021-22 soybean crop.

The supply shocks seem to be easing somewhat. Soybean production in Brazil, Argentina and Paraguay is set to recover this year. Indonesia was forced to lift restrictions on palm oil shipments in late May after stocks piled up. Additional supplies from the world’s largest producer are now putting pressure on prices.

Whether other foods will follow vegetable oils is only a matter of time.